Insurance policy protection is something which All people requirements to take into account in some unspecified time in the future within their life, but Lots of individuals overlook it right up until it's as well late. Whether or not you might be driving a vehicle, proudly owning a home, or maybe leasing an apartment, comprehending your coverage protection is crucial to ensuring that you're protected against unpredicted financial burdens. In this article, we’ll dive deep into coverage protection, describing its value, sorts, and the way to choose the greatest protection for your preferences. So, let’s discover this topic in detail!

Insurance Benefits Fundamentals Explained

When you believe of insurance plan, the very first thing that probable relates to brain is car or truck insurance policies or property insurance policy. These are generally the most typical kinds, but Do you know there are plenty of other kinds of coverage which will help secure you? By way of example, overall health insurance addresses healthcare bills, lifestyle insurance policies gives financial stability on your family and friends, and disability insurance policies supports you in the event you’re unable to perform. With lots of alternatives readily available, it’s critical to grasp what Each and every style of coverage presents and how it applies to your daily life.

When you believe of insurance plan, the very first thing that probable relates to brain is car or truck insurance policies or property insurance policy. These are generally the most typical kinds, but Do you know there are plenty of other kinds of coverage which will help secure you? By way of example, overall health insurance addresses healthcare bills, lifestyle insurance policies gives financial stability on your family and friends, and disability insurance policies supports you in the event you’re unable to perform. With lots of alternatives readily available, it’s critical to grasp what Each and every style of coverage presents and how it applies to your daily life.One of several essential facets of insurance policies protection is recognizing the amount safety you require. For example, in the event you’re leasing an apartment, you might not will need just as much coverage as a person who owns a house. However, you continue to will need sufficient insurance coverage to safeguard your possessions in case of theft, hearth, or organic catastrophe. Furthermore, should you possess an auto, your protection must not only defend versus accidents and also contain legal responsibility protection in the event you're chargeable for an accident that injures some other person or damages their house.

The earth of insurance coverage can be a bit frustrating, especially if you’re new to it. But breaking it down into easy phrases makes it easier to comprehend. Think about insurance plan as a safety Web. If a thing goes Completely wrong, whether or not it’s a car or truck incident, a dwelling hearth, or possibly a clinical unexpected emergency, your insurance protection acts being a cushion, helping to soften the blow and forestall you from sinking into money spoil. Without the need of insurance coverage, you could possibly be remaining to handle the total fiscal burden on your own, which may very well be devastating.

One more essential aspect of coverage protection is understanding your coverage’s boundaries and exclusions. It’s simple to assume that insurance policy will address all the things, but that's not always the situation. Every coverage has certain restrictions on just how much it pays out for differing types of promises, along with exclusions that define circumstances that aren't included. Such as, a normal vehicle coverage policy might not deal with problems brought on by flooding, or a home insurance policy may exclude coverage for selected pure disasters like earthquakes.

Allow’s talk about premiums. Premiums are the amount you shell out to maintain your coverage protection, usually on a monthly or yearly basis. Although paying rates is usually a important portion of having insurance, the amount you pay can vary significantly according to a number of factors. These components might contain your age, driving history, the type of coverage you select, and even where you reside. It’s crucial that you locate a equilibrium involving shelling out A cost-effective quality and making certain you might have ample protection for your requirements.

When evaluating different insurance policy vendors, It is essential to take into consideration much more than simply the worth. Even though it’s tempting to Opt for the cheapest possibility, the most beneficial insurance plan protection isn’t often the a person with the bottom premium. As an alternative, target getting a policy that provides detailed protection at an affordable cost. You'll want to evaluation what’s A part of the plan, including the deductible, the coverage restrictions, and also the exclusions. You could notice that paying a rather larger quality will give you better Over-all safety.

Comprehending coverage protection also suggests realizing when to update your plan. Lifetime changes, for instance finding married, having kids, or purchasing a new vehicle, can all impact the sort of insurance policy you may need. For illustration, Should you Gain more info have a developing family, you might want to improve your everyday living coverage coverage to ensure they’re monetarily protected if a thing comes about for you. In the same way, just after buying a new motor vehicle or dwelling, Find it here you’ll want to adjust your coverage to mirror the worth of your new assets.

One of the more puzzling elements of insurance policies is handling claims. If you ever end up inside a scenario where by you must file a assert, it’s crucial to be familiar with the process plus the techniques concerned. The initial step is to inform your insurance company immediately after the incident occurs. They are going to tutorial you in the up coming steps, which can include submitting documentation, filing a law enforcement report, or possessing an adjuster assess the damages. Understanding this method will help lessen strain if you’re presently handling a difficult situation.

Now, let’s take a look at the differing types of insurance plan protection that people typically order. Motor vehicle coverage is One of the more frequent and needed forms of coverage. In most locations, it's lawfully required to have at least fundamental car insurance plan, which addresses legal responsibility just in case you're at fault in a collision. Having said that, several motorists choose For extra coverage, which include collision or thorough insurance plan, to safeguard on their own in case of a mishap, theft, or weather-connected destruction.

Indicators on Global Insurance Solutions You Need To Know

Homeowners insurance policy is yet another essential protection for any person who owns house. This type of insurance policies commonly protects versus harm to your home a result of fire, theft, vandalism, or selected natural disasters. In addition, it could possibly protect your individual possessions and supply liability protection if anyone is hurt in your residence. For renters, renter’s insurance provides related defense but applies only to your individual possessions, not the framework of the setting up itself.Well being insurance is yet another crucial method of protection, ensuring that you're coated in case of professional medical emergencies or schedule Health care requires. Well being insurance plan plans can vary noticeably depending on the service provider, the plan, and also your unique requirements. Some ideas deal with an array of providers, while some could only include simple demands. It’s essential to thoroughly evaluate the plans available to you and take into consideration elements like premiums, protection limitations, and out-of-pocket costs before making a call.

For those who have dependents or family members who count on you economically, daily life insurance plan is a thing you'll want to strongly consider. Lifestyle coverage presents monetary protection in your beneficiaries while in the celebration of your respective death. The protection volume could vary based on your preferences and Tastes. For example, expression everyday living coverage provides coverage for the set time frame, whilst complete lifetime insurance policies delivers lifelong coverage and sometimes includes an investment part.

Disability coverage is yet another significant but generally overlooked form of protection. In case you turn out to be quickly or permanently disabled and are unable to function, incapacity insurance plan provides a source of money to assist you to keep afloat fiscally. This can be a lifesaver for individuals who depend on their revenue to assist by themselves and their families. Disability insurance policies is especially important should you don’t have other kinds of income or personal savings to drop again on.

All about Insurance Consultation Services

An alternative choice to consider is umbrella insurance coverage. Umbrella insurance policy presents further liability coverage over and further than your other insurance policies, for instance vehicle or homeowners insurance policy. When you are involved with a lawsuit or encounter a considerable assert that exceeds the bounds within your Most important insurance policy, umbrella insurance policies might help protect the remaining charges. It’s A Click to see reasonable technique to include an extra layer of security to the economic protection Web.

Coverage coverage is A vital element of monetary scheduling, and it’s something which shouldn’t be taken flippantly. Even though it might come to feel like an inconvenience to evaluate guidelines, pay premiums, and keep track of distinctive coverage types, the satisfaction that includes being aware of you’re protected is a must have. No matter if You are looking to safeguard your automobile, property, wellbeing, or everyday living, the correct insurance protection can make all the main difference while in the function of an surprising incident.

If you're still Not sure about what forms of insurance coverage coverage are best for you, it’s value consulting having an insurance agent or economical advisor. They can enable evaluate your requirements and guidebook you thru the process of picking out the proper procedures. All things considered, insurance policy is about defending oneself and also your family members, and finding it appropriate can offer a sense of protection that’s not easy to put a selling price on.

In summary, insurance protection is something that All people should prioritize. It provides a security Internet in times of require, assisting you Recuperate from unanticipated gatherings with no slipping into economic distress. With lots of types of insurance accessible, from car insurance to life insurance, it’s crucial that you Consider your needs and pick the proper coverage for your predicament. By understanding the fundamentals of insurance plan, comparing procedures, and remaining along with your protection, you could be sure that you’re guarded when everyday living throws a curveball your way.

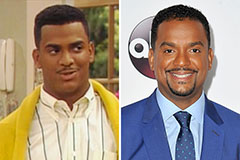

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Burke Ramsey Then & Now!

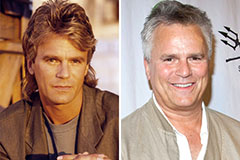

Burke Ramsey Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!